Lithium

Introduction

Lithium (from Greek: λίθος lithos, "stone") is a chemical element with symbol Li and atomic number 3. It is a soft, silvery-white alkali metal. Under standard conditions, it is the lightest metal and the lightest solid element. Like all alkali metals, lithium is highly reactive and flammable, and is stored in mineral oil.

When cut open, it exhibits a metallic luster, but moist air corrodes it quickly to a dull silvery gray, then black tarnish. It never occurs freely in nature, but only in (usually ionic) compounds, such as pegmatitic minerals which were once the main source of lithium. Due to its solubility as an ion, it is present in ocean water and is commonly obtained from brines. Lithium metal is isolated electrolytically from a mixture of lithium chloride and potassium chloride.

Lithium and its compounds have several industrial applications, including heat-resistant glass and ceramics, lithium grease lubricants, flux additives for iron, steel and aluminium production, lithium batteries, and lithium-ion batteries. These uses consume more than three quarters of lithium production.

Lithium is present in biological systems in trace amounts; its functions are uncertain. Lithium salts have proven to be useful as a mood-stabilizing drug in the treatment of bipolar disorder in humans.

Where Lithium Comes From

Lithium is never found in its elemental, metallic form because it is highly reactive: lithium is highly flammable, and will even react spontaneously with water. (This high reactivity is why some lithium-ion batteries ignite or explode when exposed to high temperatures).Lithium is usually extracted from :

1) lithium minerals that can be found in igneous rocks (chiefly spodumene)

2) lithium chloride salts that can be found in brine pools

The largest producer of lithium in the world is Chile, which extracts it from brine at the Atacama Salt Flat. Argentina also produces lithium from brine at the Hombre Muerto Salt Flat. There is also an enormous lithium deposit in Bolivia at the Uyuni Salt Flat (the world's largest salt flat), but this resource remains untapped for now due to political and economic reasons. The largest producer of lithium from spodumene is Australia, which has a large deposit near Perth. Other major lithium producers include China, which produces it at salt lakes in Tibet and Qinghai, and the United States, which produces it from brine in Nevada.

| Country | Production | Reserves | Resources |

|---|---|---|---|

| 5,700 | 2,000,000 | 9,000,000 | |

| 14,300 | 1,600,000 | 2,000,000+ | |

| - | - | 100,000+ | |

| - | - | 9,000,000 | |

| 200 | 48,000 | 200,000 | |

| 480 | 180,000 | 2,000,000 | |

| 12,000 | 7,500,000 | 7,500,000+ | |

| - | - | 1,000,000 | |

| - | - | 200,000 | |

| 2,000 | 3,200,000 | 7,000,000 | |

| 200 | 60,000 | N/A | |

| - | - | 1,000,000 | |

| - | - | 1,000,000 | |

| W | 38,000 | 6,900,000 | |

| 900 | 23,000 | 100,000+ | |

| - | - | 1,300,000 | |

| World total | 32,500 | 14,000,000 | N/A |

Extracting lithium from brine is currently cheaper than mining it from spodumene, so there are many deposits of spodumene that are not currently being mined. Lithium is also present in seawater, but the concentration is too low to be economic.

Lithium Content in Batteries

The amount of lithium that a battery must contain can be calculated with some very simple chemistry. Lithium, like the other alkali metals, only has one oxidation state and only forms ions with a single positive charge. This means that the fundamental electrochemical reaction for any kind of lithium battery, regardless of its chemistry, must be:

In the case of a lithium-ion rechargeable battery, the reaction proceeds like this: As the battery discharges, one lithium atom at the negative electrode splits into a lithium ion and an electron; the lithium ion migrates through the internal structure of the battery, while the electron exits the battery and flows through whatever circuit the battery is attached to; the lithium ion and electron then recombine at the positive electrode. The same reaction runs in reverse during recharging.

Therefore, to drive one mole of electrons through a circuit, a lithium battery must contain one mole of lithium. One mole of electrons is 26.80 ampere-hours (A·h), and one mole of lithium weighs 6.941 × 10-3 kg. [6] By dividing these numbers, I calculate that for any lithium battery, the charge capacity per kg of lithium is

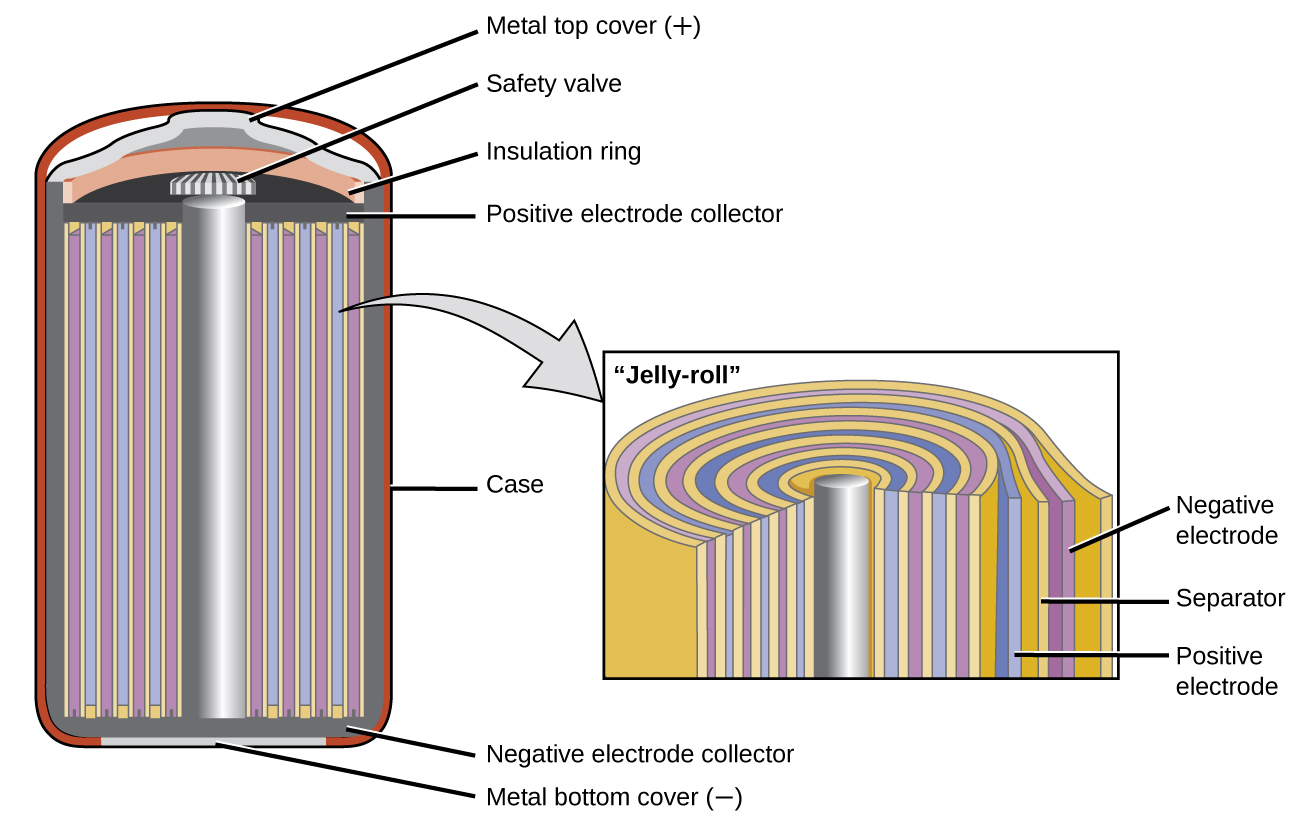

Dissecting Lithium ion battery

While there are many exciting battery technologies out there, we will focus on the innards of lithium-ion batteries as they are expected to make up the vast majority of the total rechargeable battery market for the near future.

Each lithium-ion cell contains three major parts:

1) Anode (natural or synthetic graphite)

2) Electrolyte (lithium salts)

3) Cathode (differing formulations)

2) Electrolyte (lithium salts)

3) Cathode (differing formulations)

While the anode and electrolytes are pretty straightforward as far as lithium-ion technology goes, it is the cathode where most developments are being made.

Lithium isn’t the only metal that goes into the cathode – other metals like cobalt, manganese, aluminum, and nickel are also used in different formulations. Here’s four cathode chemistries, the metal proportions (excluding lithium), and an example of what they are used for:

While all sorts of supply questions exist for these energy metals, the demand situation is much more straightforward.

Consumers are demanding more batteries, and each battery is made up of raw materials like cobalt, graphite, and lithium.

Cobalt:

Today, about 40% of cobalt is used to make rechargeable batteries. By 2019, it’s expected that 55% of total cobalt demand will go to the cause.

In fact, many analysts see an upcoming bull market in cobalt.

Battery demand is rising fast

Production is being cut from the Congo

A supply deficit is starting to emerge

“In many ways, the cobalt industry has the most fragile supply structure of all battery raw materials.” – Andrew Miller, Benchmark Mineral Intelligence

Graphite:

There is 54kg of graphite in every battery anode of a Tesla Model S (85kWh).

Benchmark Mineral Intelligence forecasts that the battery anode market for graphite (natural and synthetic) will at least triple in size from 80,000 tonnes in 2015 to at least 250,000 tonnes by the end of 2020.

Lithium:

Goldman Sachs estimates that a Tesla Model S with a 70kWh battery uses 63 kilograms of lithium carbonate equivalent (LCE) – more than the amount of lithium in 10,000 cell phones.

Further, for every 1% increase in battery electric vehicle (BEV) market penetration, there is an increase in lithium demand by around 70,000 tonnes LCE/year.

Lithium prices have recently spiked, but they may begin sliding in 2019 if more supply comes online.

Comments